For a generation of Americans over the age of 60, there are about $86 billion in student loans that they have taken to educate their children or themselves. These loans are relatively affordable because they are guaranteed by the state, but they are almost impossible to write off, and often they remain with the borrower for life.

According to the Wall Street Journal, about 93% of all new student loans this academic year were issued not only to the students themselves, but also to their parents or other adults as co-borrowers. For comparison, in 2008 this figure was 74%.

Federal (state) loans provide 90% of all student loans, while the share of private loans, though small, is gradually growing.

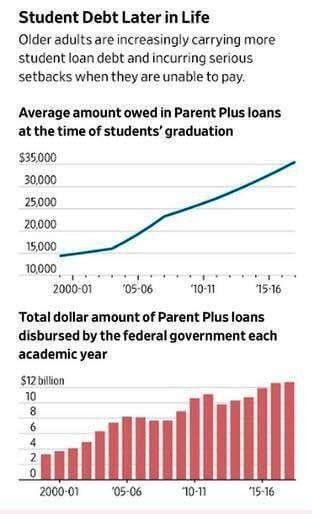

As of 2017, borrowers over 60 years of age have an average of about $33,800 in educational loans, which is 44% higher than in 2010. The total amount of student loans to older persons increased by 161% between 2010 and 2017. In all other age groups, growth was markedly lower.

Those pensioners who do not pay their student loans on time, the state can cut pensions and other social benefits. In 2015 alone, such measures were taken against 40,000 people over 65 years of age (362% more than 10 years before). Especially hard for those who took out a loan for their own education, but, for one reason or another, did not succeed and did not get a well-paid job.

In General, the total debt of Americans over 60 years in 2017 amounted to $615 billion-this includes credit cards, car loans, other personal loans and student loans. This figure is 84% higher than in 2010.

The debt problem was compounded by the fact that after the 2008 financial crisis, the US Federal reserve sharply lowered base rates, which made loans much more affordable. However, the growth of supply in the labor market at the same time was not enough for people to be able to successfully settle and repay debts.

USA: EDUCATION IN DEBT AND FOR A LONG TIME

That’s why parents in the US have to work longer and longer, postponing retirement to Fund their children’s education and help them pay off loans.

In the United States in the field of education built a system that combines the worst features of capitalism and socialism:

on the one hand, it is an absolutely socialist model in which the state guarantees loans to citizens for training, on the other — wild capitalism, with inflation and obvious cartels of educational organizations that de facto plunder both the population and the state.

The option offered by American socialists-free college for all (free education for all) — in American realities, most likely, will become the following: private universities will directly take money from the budget, and take them more and more — by analogy with American private companies from the military-industrial complex.

The capitalist option of solving the problem: to increase competition, to remove state guarantees, to break the cartels — now in the United States will not be popular, although it would be much more effective.