In the twenty-first century, Russia’s geopolitical interests are consistently moving North – to the Arctic. The Russian government plans to create a powerful mineral resource complex here in the near future on the basis of the development of the Northern Sea Route. Russia ranks first in the world among the Arctic countries-producers of mineral raw materials. At the same time, detailed metallogenic studies were carried out only for certain regions of the Russian Arctic, a significant part of which (more than 4 million tons) is located in the Arctic. The Circumarctic belt is one of the most important global metallogenic structures that formed throughout the history of the Earth, from the Archean to the Cenozoic. The length of the outer border in the Arctic is more than 12 thousand km, and the width varies from several hundred to thousands of km. The territory of the Arctic is divided on the basis of international agreements into national sectors belonging to Russia, the United States, Canada, Denmark (Greenland), Iceland and Norway.

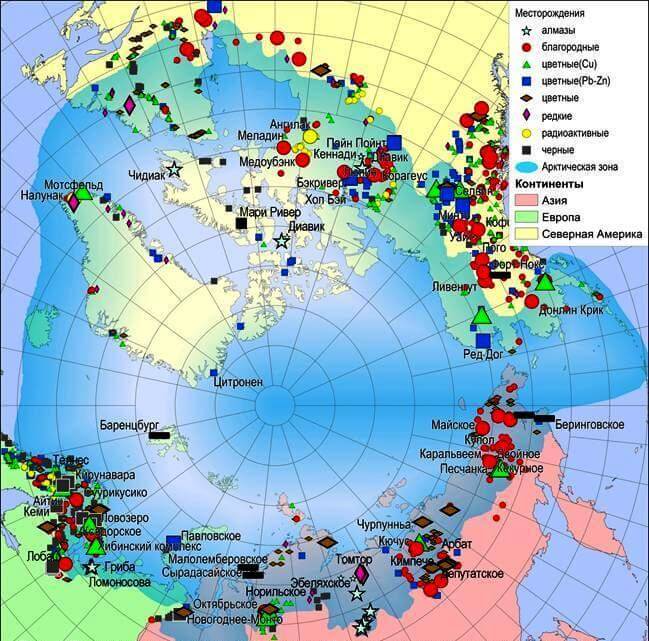

Since the beginning of the XXI century, a huge number of various minerals have been extracted from the Arctic subsurface, the main ones being Cu, Au, Ag, Pb, Zn, Ni, Ti, Cr, platinum group metals (MPG), Co, rare earth metals (REM), diamonds, phosphate raw materials, iron ores, coal, etc. The Arctic is famous for world-class Ni-Cu-MPG deposits (Norilsk Group, Pechenga Group, etc.), Pb-Zn-Ag stratiform deposits (Red Dog, Pavlovskoye, Selvin, etc.), diamond deposits (Lomonosov, Gryba, Diavik, etc.). the apatite deposits of khibin, the au-ag epithermal deposits of chukotka (dome, double), the titanium deposits of the telnes region in norway, the iron ores of the kiruna region in northern sweden, the au deposits associated with granitoid intrusions (fort knox, pogo, livengood) of Alaska, the copper-porphyry (pebble, aitik, gerbil), the gold-sulfide interspersed ores (mayskoye, donlin creek, Kuchus), etc.

Prospects for the development of Arctic mineral deposits, in addition to the scale and richness of ores, are largely determined by the proximity to the Northern Sea Route and navigable rivers, which significantly increases the profitability of mines through the use of water transport. Despite the age-old history of mining operations, the bowels of the Arctic still contain a sufficient amount of solid minerals (TPI). The IGEM RAS Arctic database, created in 2014 and constantly updated in the course of its work, currently includes information on the location of more than 26 thousand objects – ore and placer deposits, ore occurrences, and mineralization points, including more than 8 thousand in Russia. Among the objects of precious metals, there are about 400 deposits, including 33 large ones. The number of copper objects (about four thousand) includes more than 350 deposits, including 7 large ones; more than a thousand lead-zinc manifestations, including more than 200 deposits, 9 large ones. The remaining non-ferrous metal objects (more than three thousand) include about 300 deposits (6 large ones) – these are mainly Ni, Ti and Sn deposits. The group of ferrous metals (Fe, Mn, Cr) in the database is represented by more than a thousand objects, including more than 200 deposits, 9 large ones. Among the manifestations (about 450) of rare and rare earth metals, 74 objects belong to the deposits, of which three are large. There are more than 500 objects of radioactive metals, including 47 deposits. The database is linked via a coordinate system to a seamless digital geological map, the scale of which varies from 1:2500000 to 1: 50 000, depending on the subject of the layers included in the database.

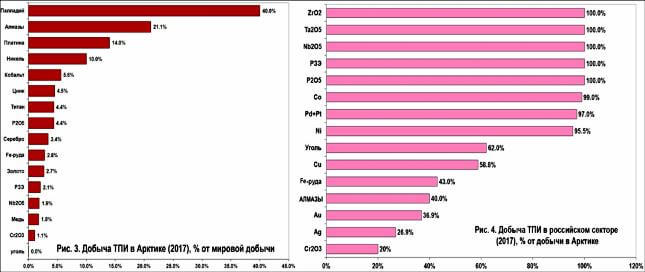

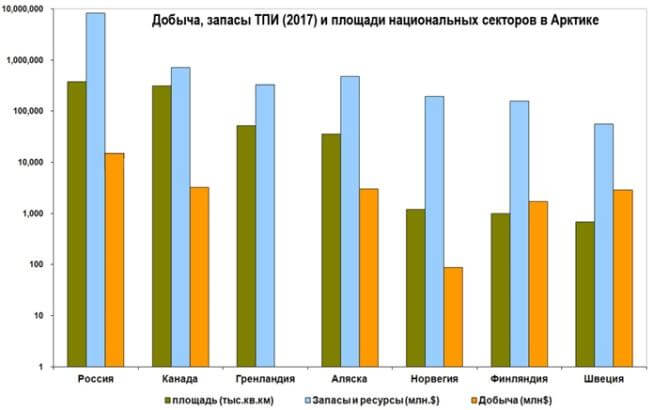

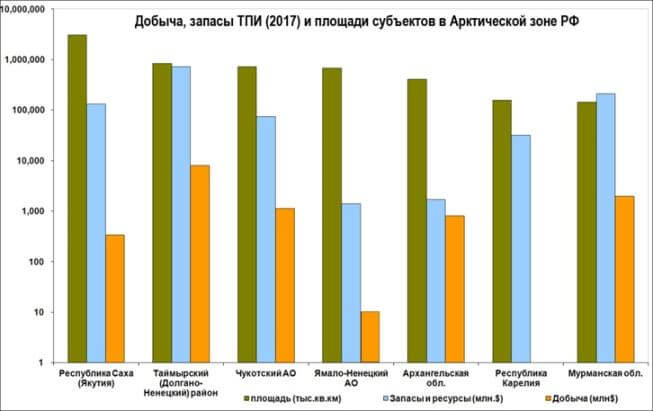

For a comparative analysis of the Arctic sectors, the amount of extracted TPI is estimated in dollars (at average annual prices for 2017). The same comparative analysis was performed for the regions of the Arctic zone of the Russian Federation. In addition, the results for the Arctic were compared with global data, and the results for the Russian sector with data for the Arctic as a whole. The share of Arctic minerals in global reserves and production was calculated based on data from the annual survey of the US Geological Survey (Mineral Commodity Summaries, 2017). The share of Arctic mineral resources in the reserves and production of the Russian Federation is determined taking into account the data of the State Report of the Ministry of Natural Resources “On the state and use of mineral resources of the Russian Federation in 2016 and 2017”.

As the calculations have shown, the mineral wealth is fairly evenly distributed across the main sectors of the Arctic. The Russian sector occupies a leading position in total mineral extraction, with Canada in second place and the United States in third with a slight lag. Among Russian regions in the cost of raw materials is the leader of the Taimyr Okrug (OAO “Norilsk Nickel”), in the second place, the Murmansk region (JSC “Norilsk Nickel”, JSC “FosAgro” and JSC “Severstal”) The third is Chukotka JSC (Kinross Gold, Polymetal, Highland Gold Mining).

Thus, the mineral resource sector of the Arctic as a whole has great growth prospects (1.5–2 times). The greatest growth potential can be predicted in the almost undeveloped territory of Greenland. the prospects for the discovery of new large deposits in the arctic sectors of russia, the united states and canada are high. In the old industrial regions of the Scandinavian countries, the stagnation of mineral extraction is likely to continue in the near and medium term.

The Russian mineral resource sector in the Arctic also has great prospects for development. The largest increase in TPI production can be predicted in the almost undeveloped territory of the northern uluses of Yakutia, Taimyr and Karelia. In Chukotka and in the Arkhangelsk region it is expected a slight increase or even stagnation of the production of mineral raw materials. Below are the results of a comparison within the national production sectors of the main types of TPI and active reserves developed and prepared for development of fields.

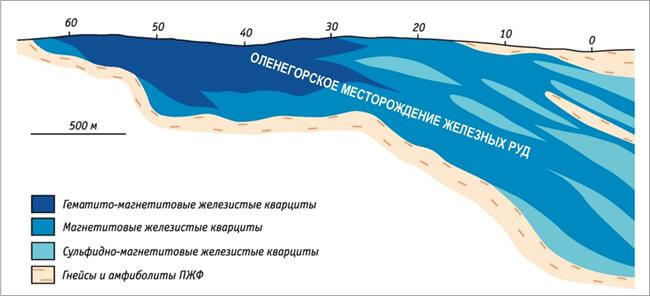

FERROUS METALS

Iron ores. The share of the Arctic in the production of iron ores does not exceed 2.8% of world production. In terms of Fe ore production, the Murmansk Region (Russia) is in the first place, where seven ferrous quartzite deposits and the Kovdor complex apatite-magnetite deposit are being developed, northern Sweden (Kiruna district) is in the second place, and the Mari River ferruginous quartzite deposit (Nunavut Canada) is in the third place. Russia’s share in total Arctic production is 43% (31.2 million tons). Underground mining in the Kiruna area is concentrated in ten mines, which currently produce 28.1 million tons of iron-apatite ore per year (39% of the Arctic). the malmberget iron oxide-apatite deposit is one of the largest in the world with estimated ore reserves of 346 million tons in 2015 with 42.5% fe. Prospects for the development of iron ore mining in the Arctic are associated with Greenland. several large iron ore areas, confined to the precambrian greenstone and orogenic belts, stretch in a peculiar chain along the western and north-western coast of the island, where massive lenses and layers of iron oxide are noted in ferruginous quartzites. in the north of canada, the production of iron ore at the marie river field, according to the company’s plan, when the project reaches full capacity, will reach 10 million tons.a unique feature of this canadian mine is the transportation of ore by rail to a deep – water berth.

Chrome ores. chrome ore mining in the arctic is carried out at the kemi field, northern finland and the tsentralnoye field in the yamalo-nenets autonomous okrug (yanao), russia. The Kemi deposit is represented by stratiform chromite bodies in a stratified basite-ultrabasite intrusion. In January 2015, ore reserves, according to the company, amounted to 48 million tons with a content of 25.9% Cr2O3, and mineral resources, mainly assumed, – 100 million tons, 29.4% Cr2O3. In 2017, Kemi produced 2.4 million tons of ore, and the processing plant produced 400 thousand tons of ore. tons of lump (36% cr2o3) and 850 thousand tons of metallurgical concentrates (45% cr2o3). Deposits and chromite deposits of Yamal is confined to the Alpine-type ultrabasic massifs of the Polar Urals. within the rai-iz massif, two deposits have been explored, which together account for 12.3% of the country’s chrome ore reserves: central – 3.5 million tons with an average content of 37.73% cr2o3 and western-2.9 million tons with 39.07% cr2o3. The forecast resources of chromites in the Yamal-Nenets Autonomous District are 21% Russian-24.4 million tons in the Ray-Iz massif (13 million tons in the depths of the Central field, 1.9 million tons in the West) and Voikaro – Synyinsky (5.2 million tons).

In 2016, the Tsentralnoye field produced 299 thousand tons of chrome ore, or almost two-thirds of Russian production. In the Murmansk region, there is a Sopcheozerskoye deposit containing 9.5 million tons of chromium ores (almost 19% of the country’s reserves) with an average Cr2O3 content of 25.7%. Two chromite ore occurrences have been identified in the vicinity, and the projected resources of the P1 category are 11.9 million tons. Enormosity the Fiskenaesset complex in West Greenland holds numerous chromite bodies. The intrusive bodies of the complex, extending in a strip of more than 200 km with an average width of 400 m, have total resources of about 100 million tons of low-quality chrome ore. however, as the finnish experience shows, modern and cost-effective technological solutions for the enrichment of poor high-ferrous chromium ores of greenlandic facilities will allow them to be involved in development.

NON-FERROUS METALS

Nickel. Arctic nickel accounts for 10% of global production. Over the past five years, nickel production has decreased by 4.5%. Nickel production is mainly carried out by Russia and a small amount by Finland. The share of Russian nickel in Arctic reserves and production is 95.5%. Here is the seventh part of all world reserves of nickel ores. At the same time, the share of Arctic nickel in the reserves and production of the Russian Federation is 70.5% and 83.3%, respectively. PJSC Norilsk Nickel operates three fields in the north of the Krasnoyarsk Territory (Zapolyarny branch) and four fields in the Pechengsky Ore district (JSC Kola MMC). In 2017, Norilsk Nickel provided almost 93% of the country’s nickel production (217 thousand tons), which is 8% less than the previous year, due to the reconstruction of production. Potential nickel resources are found in Greenland, where nickel sulfide mineralization occurs in basic and ultrabasic rocks in the central part of Western Greenland.

Cobalt. russian co production in the arctic (pjsc norilsk nickel) – 5.6 % of world production; active reserves – 3.3% of world reserves. Cobalt is extracted along the way in the main production of copper and nickel. The share of Russian Co in Arctic reserves and production is 99%.

Titanium. The Arctic (Norway) produces about 4.4% of the world’s titanium. Norway holds one of the leading positions in the world in terms of titanium ore reserves (4.8%). The share of Russian titanium ores is 42% of the Arctic reserves. At the same time, the share of Arctic ores in the Russian titanium reserves is about 9%. In Norway, the main industrial interest is the province of Eigersund, where the Telnes deposit, the largest in Europe, is known with total ilmenite reserves of 300 million tons and active reserves of 64 million tons. In 2017, 260 thousand tons of ilmenite concentrate were produced here. Norwegian Nordic Mining ASA has been trying to develop the unique Engebo rutile deposit for more than a decade. With a mine capacity of 10 million tons/year, it is possible to produce 200 thousand tons of rutile concentrate annually, simultaneously extracting garnet concentrate.

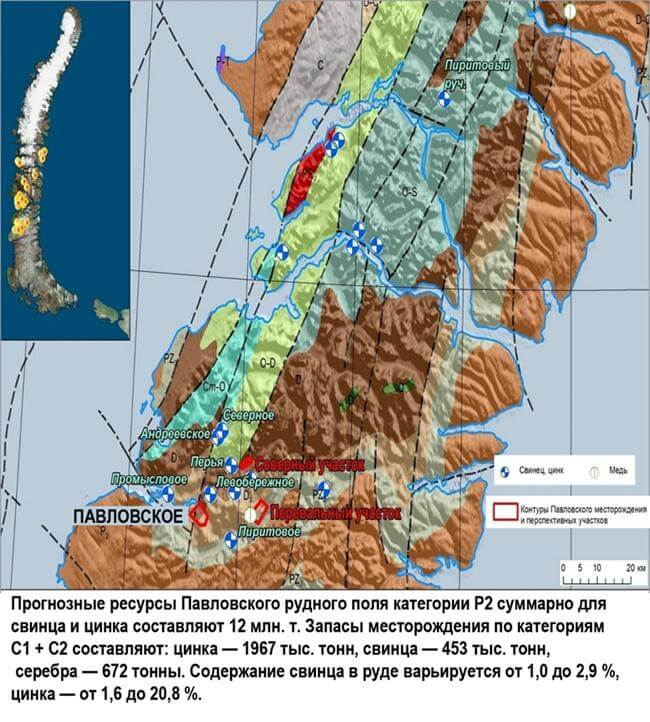

Zinc. The total volume of zinc production in the Arctic is 4.5% of world production, and the share of Arctic ores in world reserves is 3.8%. It should be noted that production in the Arctic has almost halved compared to 2002, which is due to an increase in zinc production in other regions of the world. The share of Russian zinc in the Arctic reserves is 13%. At the same time, the share of Arctic zinc in the reserves of the Russian Federation is small – 4.2%. Alaska still extracts almost all of the Arctic zinc. the red dog mine is one of the largest in the world, the quality of ores exceeds all known deposits by 2-3 times. however, by 2012, its main reserves were worked out and the mine quarry was moved to the neighboring akkaluk field, which will last until 2031.

In Russia, only one zinc deposit has been explored-Pavlovskoye (O. Novaya Zemlya), – which is comparable to foreign analogues in terms of ore quality. Construction of the GOK at the field has been going at a snail’s pace for more than seven years. In the foreign Arctic, numerous pyrite and stratiforom polymetallic deposits rich in zinc are at the exploration stage: Lik-40 km from the Red Dog mine (Alaska) and Selwyn (Yukon, Canada), as well as a group of deposits in the Hackett River area (Nunavut, Canada). In the north of Greenland in the area of the Citronen Fjord, 102 million tons of ore were explored with a content of 4.7% zinc and about 2% lead.

Lead. The development of the Arctic mineral resource base of lead is largely due to plans for the extraction of zinc. Compared to 2002, the share of Arctic lead production (Alaska) in world production has halved (and is 2.37% of the global total), as well as zinc. Lead in the Arctic is mined along with zinc (Red Dog and Green Creek mines, Alaska) and to a lesser extent with zinc and copper. The share of Russian lead in the Arctic reserves is almost 18%. At the same time, its share in the reserves of the Russian Federation is small – 4.3%.

Copper. The Arctic provides only 2.7% of the world’s Cu production, mainly in Russia and to a lesser extent in Sweden and Northern Finland. The share of the Arctic in the world’s active Cu reserves is about 9%, the leaders are Russia and the United States (Alaska). It should be noted that since 2002, the share of Arctic Cu in world production has almost halved, as well as lead and zinc. The share of Russian Cu in Arctic reserves and production is 50.1% and 58.8% (387.64 thousand tons in 2017), respectively. The share of Arctic Cu in the reserves and production of the Russian Federation is more than 40% and 54.4%, respectively. Moreover, more than 30% of Russia’s active Cu reserves are concentrated in the sulfide Cu-Ni deposits of the Norilsk ore district: in Oktyabrsky (more than 22% of Russia’s copper reserves) and Talnakhsky (11.6%).

In Chukotka, copper reserves of the cu-mo-au-porphyry deposit of peschanka amount to 3.7 million tons, or 4% of russian reserves. in addition, 5.95 million tons of forecast cu resources of category p1 are located in the bowels of the baim zone – almost half of the most reliable cu resources of the country. Cu-Au-porphyry field Aitik, Skelet district, Swedish Lapland is the second largest producer of Cu in the Arctic after Norilsk (97.6 thousand tons in 2017, according to Boliden). The largest quarry in Europe operates here. The ores contain on average 0.3 % Cu, 0.1 g / t Au and 2 g / t Ag. It should be noted that Cu production in the Arctic has significant growth prospects. The reserves of the Alaskan Cu porphyry deposit Pebble (36 million tons), as well as related components, are ten times larger than its Russian counterpart-Gerbil. however, the start of construction of the world’s largest mine in this field is hindered by a significant environmental risk.

Molybdenum. Several large molybdenum deposits have been explored in the Arctic. In addition, large reserves of molybdenum are estimated as associated raw materials in the Pebble and Gerbil deposits. The share of the Russian Defense Ministry in the Arctic reserves is 2.36%, and in the reserves of the Russian Federation-4.7%. In the east of Greenland, a large Malmberg deposit has been identified, with resources exceeding 410 thousand tons, and an average molybdenum content of 0.15%. In Norway, in the Hurdal area, molybdenum production is planned at the Nordi field. The field’s resources are 210 million tons. t., with an average molybdenum content of 0.13%.

The uboininskoye deposit is located near the village of dixon, these ores are characterized by a high (up to 0.15%) content of molybdenum. in the arctic regions of karelia, a large molybdenum deposit lobash is known. reserves of stockwork ores of the deposit in category c1 56.9 thousand tons with an average content of molybdenum 0.068%; in category c2 71.2 thousand tons 0.059%. geological and economic analysis shows that currently several large molybdenum mines have been put into operation in the world (usa, canada, chile, peru, australia, etc.), which the arctic deposits cannot compete with.

tin. The russian arctic zone is home to the largest small and medium-sized tin industry in the world. Here there are two unique ore-placer districts: North-yanskiy (Yakutia) and Perekisi (Chukotka). in the 90s, tin production from ore deposits and placers in these areas exceeded 15 thousand tons per year. currently, the production of tin and tungsten in them is stopped for economic reasons. the share of russian tin in the arctic reserves is 100%, and in the reserves of the russian federation-about 50%. the stewart peninsula (alaska) is also promising for the discovery of new tin ore deposits.

Tungsten. In Arctic Russia, tungsten production was stopped in the mid-90s of the last century, and in Canada-in 2015, due to the economic situation on the market. The share of Russian Gas in the Arctic reserves is almost 43%. At the same time, its share in the reserves of the Russian Federation is small-5.1%. The main proven reserves of indigenous and alluvial tungsten are concentrated in Iultinsky (more than 50% of all reserves), Chaunsky (24.8%), Schmidtovsky (Chukotka) and Severo-Yansky (Yakutia) districts. In the case of resuscitation of these mines, the production of tungsten will increase in proportion to the production of tin.

PRECIOUS METALS

In recent years, the high level of world prices for precious metals is the main reason for the development of geological exploration and the commissioning of new mines in remote areas of the Arctic. Regardless of the wide range of mineral resources in the Arctic, historically gold remains the main target for geological research.

Gold. In the current global Au production, the Arctic accounts for 2.7%, and the share in global reserves is more than 13.4%. The main gold production is concentrated in the Chukchi Autonomous Region (Russia) and Alaska (USA); to a lesser extent in Northern Canada (Nunavut) and the Scandinavian Arctic, in addition, small Au production existed until 2013 in Greenland. Along the way, Au is extracted in significant quantities from the Norilsk group of Cu-Ni deposits and the Cu-Au-porphyry Aitik deposit (4.5 tons and 1.7 tons, respectively). About 7 tons of Au are extracted annually from placers in the Arctic (Alaska, Yukon, Chukotka, Yakutia). the share of russian au in arctic production as a whole is 36.9%. At the same time, the share of Arctic gold in the reserves and production of the Russian Federation is 11.2% and 9.75%, respectively. Prospects for significant growth in gold production in the Arctic are associated with the commissioning of several new large deposits: Donlin Creek, Levingut and Pebble (Alaska), Peschanka and Kekurnoye (Chukotka), five fields in the Yukon Province, two in Nunavut and one in the Northern Territories (Canada). in recent years, active searches for new gold deposits have been carried out on the territory of iceland and svalbard, where promising ore occurrences have been discovered.

Taimyr is a new, potentially large gold-bearing region in the Russian Arctic. total gold resources are estimated at 2000 tons. several potential gold mining areas are outlined on the bolshevik island of the severnaya zemlya archipelago and northern taimyr, which also include a significant number of placers. Of undoubted interest as a secondary source of gold for the formation of placers are the gold-bearing conglomerates known on the Chelyuskin Peninsula, on the Taimyr Peninsula, in Northern Karelia, in the area of the Windy Belt (Niminga, Arkhangelsk region), as well as in northern Yakutia. the main volume of reserves (more than 85%) and resources (at least 70%) within the shelf area is concentrated on islands and near the coastline. A new promising area where large reserves of gold of the Karlin type can be expected is the Kylakh metallogenic zone in the North of Yakutia. In 150 km to the west of this area, a large and rich deposit of resistant gold Kyuchus (180 tons of reserves and the same amount of resources, with a content of 7-10 g/t) has been explored.

Platinum group metals (PGMs). Arctic Russia alone produces 40% of the world’s palladium and 14% of platinum. a small amount of mpg is mined in northern finland. The share of Russian MPG in Arctic production is 97%, in reserves-98%. At the same time, the share of Arctic MPGs in the reserves and production of the Russian Federation is 94.6% and 95.4%, respectively. in the russian arctic zone, large low-sulfide mpg deposits have been discovered relatively recently: maslovskoye, verkhnetalnakhskoye, norilsk, chernogorskoye and imangdinskoye in the norilsk region, fedorovo-panskoye and monchegorskoye on the kola peninsula. The mineralization of gold-copper-palladium type is established in the lava flows of the dollerites of Alexander Island of Franz Josef Land. In northern Finland, the resources of the Sukhanko group of deposits amounted to 528 t MPG (Pd/Pt = 4/1). Since 2016, the Swedish company “Boliden AB” has been developing the low-sulfide field of Kevits in the same area with reserves of MPG-65 tons and resources – 129 tons. In 2017, 2 tons of MPG were produced. Stock availability – more than twenty years.

Silver. The Arctic extracts about 3.4% of the global amount of silver; the share in the world’s reserves is ~ 4%. About 70% of production is in Alaska, 26.9% in the Russian Arctic, and the rest in Scandinavia. The share of Arctic silver in the reserves and production of the Russian Federation is 11.16% and 13%, respectively. All Arctic silver is produced simultaneously from polymetallic and gold-silver epithermal ores. Prospects for the development of silver mining are associated with the development of polymetallic deposits in the Hackett River area (Nunavut, Canada) and the Kimpiche field (Northern Yakutia). Volcanogenic massive sulfide (VMS) ores of Hackett River with an age of 2.67 billion years. years are more enriched in silver (up to 3000 g / t) compared to other similar deposits of similar age. On the territory of Chukotka, great prospects for the discovery of numerous new polymetallic deposits enriched in gold and silver are established in the Mainitsa metallogenic zone, Chukotka (the Ugryumoye ore occurrence, etc.).

RADIOACTIVE, RARE AND RARE EARTH METALS

Uranus. In the Arctic uranium is not mined, although a large number of deposits and ore occurrences have been identified. The most promising field in terms of production is the Kigavik area, located in the Thelon basin northeast of the province of Athabasca (Nunavut, Canada). Its reserves are more than 50 thousand tons, and the average content of 0.47% of uranium. In the Arctic zone of Greenland, the largest uranium-bearing area is known, associated with the multiphase alkaline intrusive complex Ilimausak, whose total resources are estimated at 600 thousand tons of U3O8. Within Arctic zone Russia is most promising for the discovery of uranium deposits in the territory of the poorly studied Anabar shield.

Niobium and tantalum. The global growth of steel production determines the demand for Nb, and the development of the electronics industry (consumes more than 50%) – Ta. Another main application of Ta is superalloys (within 20%). Production of Nb and Ta with subsequent extraction is carried out in the Arctic only from complex loparite ores of the Lovozersky deposit, which contains 30 and 26% of the balance reserves of these metals in Russia. the expected high level of demand for these metals from the russian industry in the future is planned to be met by commissioning the tomtorsky mine in the north of yakutia. However, geological and economic calculations show that Tomtor can compete with Brazilian deposits only on the terms of preferences provided by the state. in southern greenland, in the gardar region, the motzfeld field has been discovered, which is considered one of the largest tantalum deposits in the world. According to the results of the assessment, it is represented by low-grade pyrochlore ores in the amount of 600 million tons.

Lithium. The best parameters in Russia, in terms of reserves and Li2O content, are the Kolmozerskoye and Polmostundrovskoye fields of the Murmansk region (34% of reserves from Russia). In addition, these same fields contain 14% of Russia’s Be reserves and about 3% of Ta. In Russia, the use of Li and its compounds has so far been limited mainly to the defense industry. Developing a high-tech industry, Russia will use Li in increasing quantities. In all likelihood, by 2025. the demand for Li may increase several times compared to its current level and amount to at least three thousand tons / year.

Rare earth metals (REM). Almost all the balance reserves of Russian REM are associated with deposits in the Arctic zone. The main share – more than 40%, is concluded in the developed Khibiny deposits of apatite-nepheline ores. The remaining reserves are complex loparite ores (together with Ta, Nb, Ti) of the Lovozersky deposit (more than 25%) and weathering crusts of rare metal carbonatites of the Tomtor deposit containing associated Nb (about 10%). The complex Lovozerskoye deposit (Murmansk region) is the only one in Arctic Russia from which REM ores are extracted (about 7 thousand tons of concentrate per year).

The explored reserves of the deposit are mainly represented by metals of the cerium group and make up more than 25% of the Russian ones; the average content of the amount of rare earth oxides in ores is 1.12%. The resulting loparite concentrate with a content of REE-28-30% is sent for metallurgical processing to the Solikamsk Metallurgical Plant (SMZ), where carbonates and oxides of mixed REE are produced from it. Over 70% of REE is used at the enterprises of JSC “Russian Electronics” and the holding “Shvabe” (part of the State Corporation “Rostec”); 20-25% – in the system of Rosatom; 5% – in the metallurgical sector (as additives to alloy steels); the rest – in petrochemicals and other industries. annual production does not exceed 2500 t ∑tr2o3. In recent years, deliveries to the Russian market have grown 2.2 times.

Another unique Tomtorskoye field is located in the Arctic zone of Yakutia. Within its limits, only the Buranny site has been explored, whose reserves are 0.7% Russian. The main components of ores are Nb, REM and Sc. The ores are characterized by a very high content of REM – 7.98% ∑TR2O3. The mining plan of the state Corporation rostec is set to begin in 2020 Field Kvanefjeld (of Connecuit) in Greenland is one of the largest in the world reserves of U and REE, near Gardar. Here, in recent years, have been discovered in two more field Kilawat and Alankrit. In 2015, Greenland Minerals announced new total resources for three deposits: 1010 million tons of ore containing 270 thousand tons of U3O8 and 11.13 million tons of TR2O3. But it will take at least ten years to increase the production of rare earth metals at the expense of the above-listed facilities. According to the State Program, Russia should achieve self-sufficiency in REM by 2020 and completely abandon imports. According to the calculations of the Ministry of Industry and Trade, the demand for REM in the Russian Federation by 2020 will be 5-7 thousand tons, according to the optimistic forecast-up to 13 thousand tons. The calculations provide for the export of 7-10 thousand tons per year, if the program is implemented in full. It should be noted that with the annual processing of more than 7 million tons of apatite, extracting REM along the way, Russia would be able to meet almost 50% of world demand. However, REM is not extracted from the deposits of the Khibiny group.

DIAMONDS

In the Arctic, about 21.1% of global diamond production is extracted; the share in world reserves is ~ 30%. More than 60% of production is in Canada, and 40% – in the Russian Arctic. Note the parity in diamond reserves in the Canadian and Russian Arctic sectors. In Canada, diamond production is concentrated at three mines Ekati, Diavik and Gacho Kae: in 2016, 7.5, 7.5 and 4.5 million carats were produced, respectively, with reserves of 124, 42.5 and 55.5 million carats, respectively. in addition, preparations are underway for the development of two more diamond-bearing pipes kennedy knorf and chidliak, the estimated resources of which are estimated at a total of 40 million carats. In the Russian sector of the diamonds mined in Arkhangelsk region and in the Anabar in the North of Yakutia. the arkhangelsk diamond-bearing province is 21.4% of all-russian diamond reserves, the second place after yakutia. As of January 01, 2017, the proven diamond reserves (B+C1+C2) of the Arkhangelsk region deposits amount to 248.3 million carats. in 2017, as a result of the successful work of goks, they decreased by 7.5 million rubles. carat – 15% of the total Russian diamond production. The production of alluvial diamonds in the Anabar ulus of Yakutia is carried out by JSC “Anabara Diamonds” at two mines: “Mayat”and ” Molodo”. In 2016, according to the company, 5.1 million carats ($331.9 million) were produced. According to the company’s development strategy until 2026, annual production is planned at the level of 4.6-4.7 million carats, and the total volume of diamond production is 56.3 million carats. Prospects for the development of Arctic diamond mining in Russia are associated with the development of huge reserves of technical impact diamonds of the Popigai meteorite crater in the north-east of the Krasnoyarsk Territory.

PHOSPHATES

The share of the Russian Arctic sector in the global production of phosphorous (apatite) concentrate is only 4.4%, and the quality of its products is very high. Russian mineral fertilizers are one of the main branches of the Russian chemical industry with an annual turnover of more than $ 10 billion. More than 70% concentrated in the limits of the Khibiny-Lovozero mineral areas of the Murmansk region. The total reserves of the nine deposits are 447.5 million tons in terms of P2O5, with an average ore content of 7.5 to 17.24%. Forecast resources of 15.3 million tons are localized within the group. the availability of reserves of jsc “apatit”, which owns licenses for the development of most of the reserves, in the open – pit mining circuits is 15-40 years, and in the underground mining circuits-more than a hundred years. in addition, complex apatite-magnetite-baddeleyite ores in the carbonatites of the kovdorsky deposit have been explored in the murmansk region. the average content of p2o5 is 6.6%, reserves are estimated at 97.6 million tons. Apatite-staffelite ores are also confined to the weathering crust of the Kovdorsky massif, in which the P2O5 content is higher and amounts to 16.8%, but their reserves are significantly less and are estimated at 6.2 million tons. In addition, on the flanks and deep horizons of the field, the forecast resources are estimated at 56.1 million tons. in recent years, due to favorable conditions in the domestic and foreign markets, the volume of phosphate production in the murmansk region has been growing.

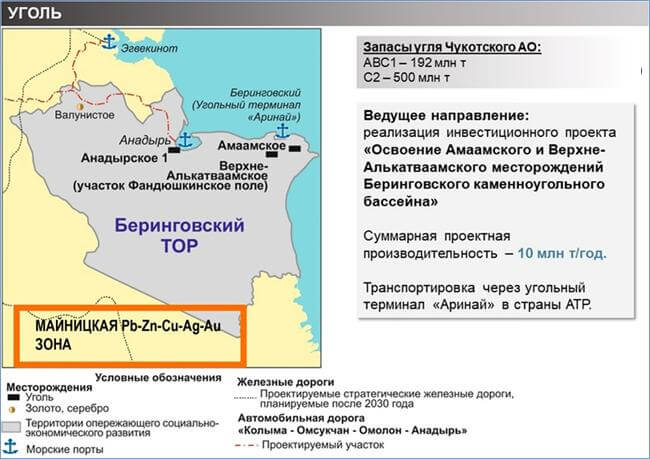

COAL

Coal production in the arctic does not exceed 2.5 million tons per year – about 0.003% of world production. Production in the Russian sector, including Svalbard, is about 62%, the remaining part of the coal is produced by the Uzebeli mine (Alaska, USA). The share of production in the Russian Arctic is only 0.03% of the total production in the country. Coal reserves and resources in the Arctic are insignificant, a share in world reserves (~1%). In the Russian sector, coal production is concentrated in three regions: Chukotka JSC (Nagornaya mine and Bering Basin sections), Malomberovsky field (Taimyr) and Barentsburg (Svalbard). the total reserves of the bering coal basin, as well as taimyr, are estimated at more than 1 billion tons. by 2030, annual production volumes in each of the regions can reach 10-12 million tons of high-quality coal.

CONCLUSION

The analysis showed that, despite the age-old history of mining operations, the bowels of the Arctic still contain a sufficient amount of TPI. The state of the mineral resource base of TPI in the Arctic is quite satisfactory and ensures the sustainable development of the economy of the Arctic countries.

Currently, Ni, Cu, MPG, Di, P2O5, Zn, Pb, Au, Ag, Fe ores, Ti, etc. are of the greatest importance for the mining industry. The mining industry, despite environmental problems, has significant prospects for development in almost all sectors of the Arctic and, in particular, in the territory of the Arctic zone of Russia. the production of mineral raw materials in the arctic can increase by 1.5-2 times, this is allowed by the existing active reserves.

Undoubtedly, the huge potential of yet undiscovered deposits in the Russian Arctic sector deserves more attention from Rosgeologia Corporation and other Russian and foreign exploration and mining companies. Here it is possible to open several new large deposits of strategic types of mineral raw materials.